Entravision Communications (EVC) has had a lot against it in recent time. Not only is broadcasting generally viewed as a structurally dying industry, but Meta’s decision to wind down its ASP program in March last year led to EVC’s sales taking a ~ 53% hit. The stock dropped more than 60% and is still sitting 45% below the pre-news price.

As a response, EVC sold its digital advertising representation business to Aleph Group for $16.4m, narrowed in on news programming, revamped its sales management structure, and reorganized business units.

The appointment of Brendan Carr as chairman of the Federal Communications Commission (FCC) has brought new life to the industry, with many expecting significant deregulation and increased market consolidation through M&A activity as station caps are lifted. EVC’s radio and TV station portfolio could see a significant uplift in its valuation as willing buyers with deep pockets begin picking up media assets, with its rapidly growing Ad-tech business potentially adding to the upside.

Business Model

EVC is the owner and operator of one of the largest networks of Spanish-language television and radio stations in the United States, providing advertisers with multi-channel marketing to engage with the Latino audience. It also owns and operates a smaller portfolio of television stations that broadcast English-language programming, and provides programmatic advertising technology and services.

Its operations are divided into two segments: (1) Media and (2) Advertising and Technology Services. The Media segment includes television, radio, and digital marketing operations, while the Ad-tech segment delivers performance-driven programmatic advertising and technology solutions through Smadex, its data-powered buying platform, and Adwake, its digital marketing unit specializing in user acquisitions and ad campaign execution.

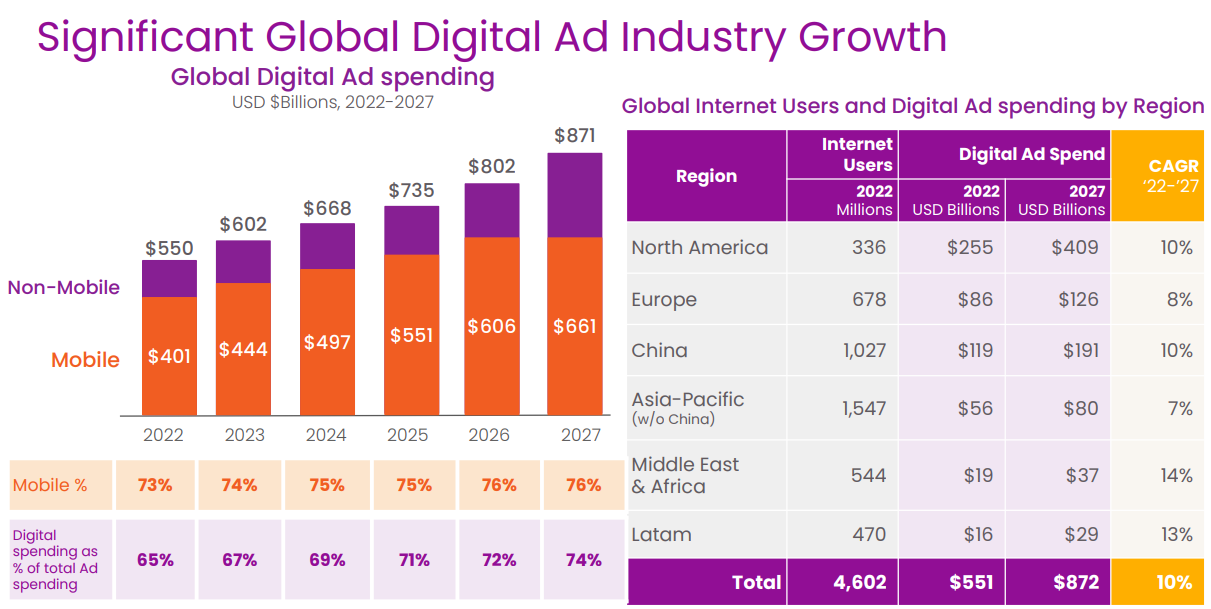

With US advertisers spending close to four times more advertising dollars on digital channels compared to TV and radio, and the former continuing its rapid growth trajectory, it is good to see the Ad-tech trucking along well and now constituting close to 40% of total sales.

From EVC’s December 2023 Investor Presentation

EVC owns and operates 44 radio stations (37 FM and 7 AM) and 49 TV stations. 39 of the radio stations are located in the top 50 Latino markets in the US, broadcasting into markets with around 19m US Latinos, according to the media research company Nielsen, or approximately 31% of the total Latino population in the country.

Smadex is a demand-side platform (DSP) that helps mobile app companies advertise more effectively by using automation and proprietary data. Instead of manually choosing where to show ads, Smadex lets advertisers buy ad space automatically across mobile apps, websites, audio platforms, and connected TVs. Its engineering team and use of exclusive data allows for smarter targeting, faster campaign optimization, and stronger performance. This makes it easier and faster to reach the right audiences, helping apps get more downloads or users, and improving ROAS.

Adwake focuses on helping apps grow by creating custom advertising strategies. It specializes in finding new users, building brand awareness, and re-engaging people who’ve used the app before. By using a mix of different platforms and ad formats, Adwake ensures that apps get high-quality traffic and scale their presence effectively.

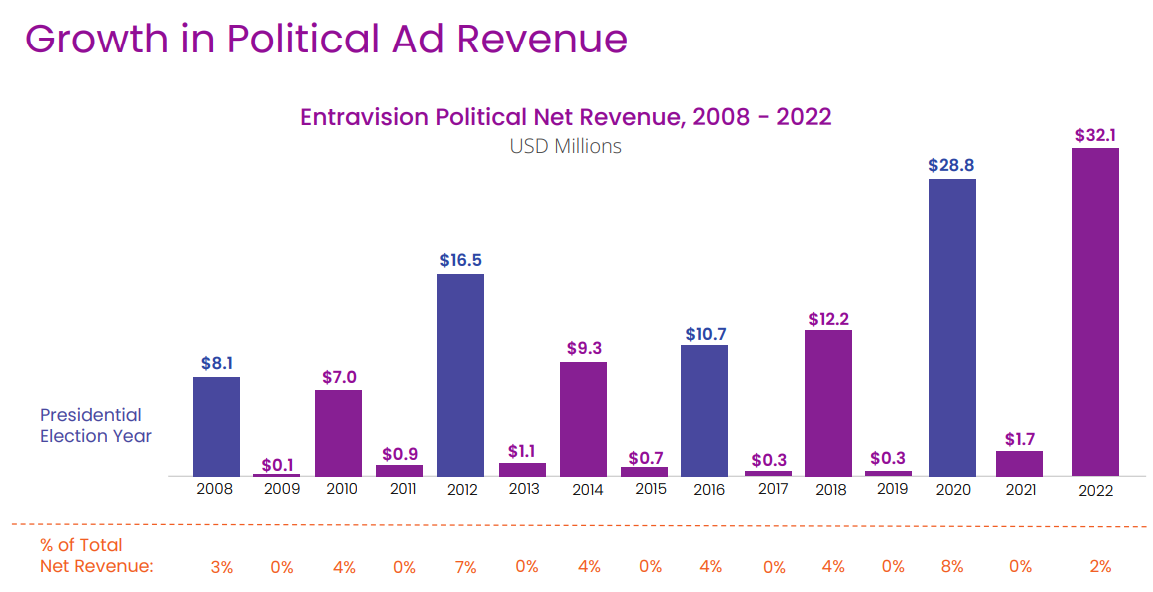

With media properties in 13 out of the 20 highest-density US Latino markets and Latinos representing an estimated 14.7% of all eligible voters in the 2024 election (an all-time high), EVC’s significant reach enhances the value of its offering during election years. Since 2008, its political net revenue has risen 4-fold — a trend that is likely to continue as the US Latino Population grows.

Also From EVC’s December 2023 Investor Presentation

Change in Share Structure

The saddening passing of founder and CEO Walter Ulloa in December 2022 had two main implications for EVC. Firstly, EVC’s Second Amended and Restated Certificate of Incorporation led to each share of Class B common stock being converted into Class A common stock upon his death. This in turn improved shareholder democracy and significantly increases the likelihood of a takeover as buyers no longer need to negotiate with a single controlling shareholder in a transaction.

It also led to a pivot away from family-run, value-destructive leadership with the introduction of Michael Christenson as CEO shortly after. He prioritized proven investments, efficient operations, and sensible capital allocation, with dividends being the main priority, followed by organic growth and deleveraging.

The elimination of a dual-class share structure, a shareholder-focused CEO, and potential FCC deregulation should materially increase the probability of M&A activity - either through a complete takeover or the sale of individual assets to the highest bidders.

Management and Compensation Structure

Michael Christenson was appointed as CEO of EVC in July 2023, bringing vast experience from both investment banking and cloud-based and security software. Having held IB and investment advisory positions for close to 30 years, Christenson seems like the ideal CEO as the broadcasting industry is potentially entering a period of increased deregulation and market consolidation.

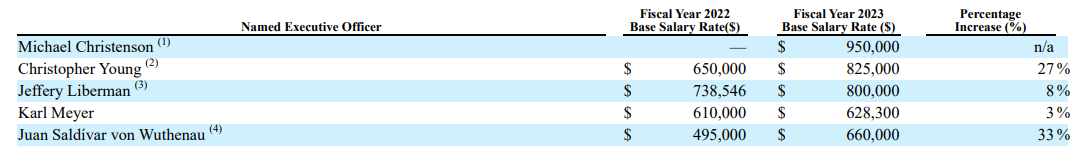

Key insiders own around 8% of outstanding shares, and the current compensation structure seems to correctly incentivize the management team. Still, Christenson’s 2023 pro-rated base salary of $950k (close to $2m annualized) is unusually high, especially given EVC’s position as the smallest broadcasting operator. The rest of the management team has annual base salaries in the range of $630k-$825k, or less than half of what Christenson takes in.

From EVC’s 2024 Proxy Statement

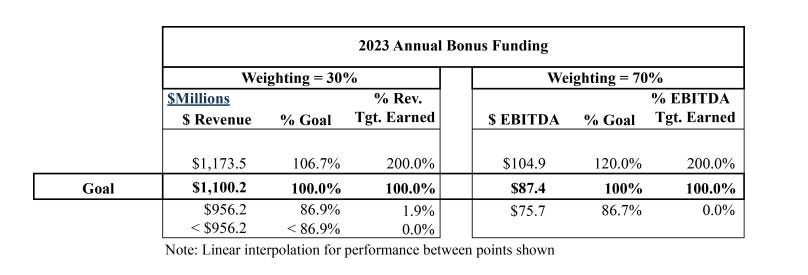

After Ulloa’s passing, the board moved away from a largely discretionary cash bonus plan, replacing it with a performance-based annual cash bonus plan. The plan also allowed the board to adjust the bonuses by up to 50% based on the compensation committee’s assessment against qualitative factors including market share, customer experiences, expense control and stock price performance.

Also From EVC’s 2024 Proxy Statement

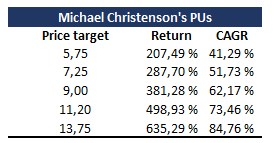

In addition to the strictly cash based compensation, key executives were granted 245,000 RSUs in February 2023, vesting over the period 2023-2026. Christenson, on the other hand, was granted a combination of RSUs and PUs when he was hired in July the same year. Half of his initial equity awards (1,000,000 units) were granted as PUs, and will be earned only if the average closing price of our Class A shares common stock over 30 consecutive trading days equals or exceeds five specified share price hurdles of $5.75, $7.25, $9.00, $11.20 and $13.75 within five years after grant (with each price hurdle subject to equitable adjustment to reflect dividends or other changes to our capitalization during the performance period). Each price hurdle earns 1/5 of the 1,000,000 PUs.

In other words, Christenson will only earn the granted PUs if EVC’s stock price rises between 200%-600% over the next 3.25 years, equivalent to annualized returns of 41% to 85%.

His 1,000,000 RSUs are subject to time-based vesting, in which 20% of the units were vested in July last year, while the remaining 80% are vested in eight equal semi-annual installments thereafter.

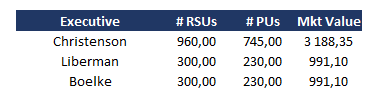

More interestingly, EVC filed an 8-K on April 4 this year, announcing that the Compensation Committee had made certain changes to the executive compensation program. This included reductions in the annual base salary of Christenson, Liberman (COO) and Boelke (CFO) of 47%, 38%, and 25%, respectively, and the exclusion of the executives from EVC’s Executive Cash Incentive Bonus Plan in 2025. Instead, they were granted additional RSUs and PUs as shown below.

The awarded RSUs vests as follows: (i) 25% on December 20, 2025; (ii) 25% on December 20, 2026; (iii) 25% on December 20, 2027; and (iv) 25% on December 20, 2028.

The fact that all three executives were willing to take a meaningful cut to their annual base salary and opt out entirely from the cash bonus plan not only better aligns their interests with those of shareholders, but also signals their confidence in EVC’s long-term value.

Valuation

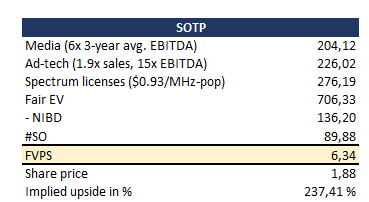

EVC’s value is comprised of three main parts: (1) Media (traditional TV and radio stations), (2) Ad-Tech (Smadex and Adwake), and (3) Spectrum Licenses.

Media

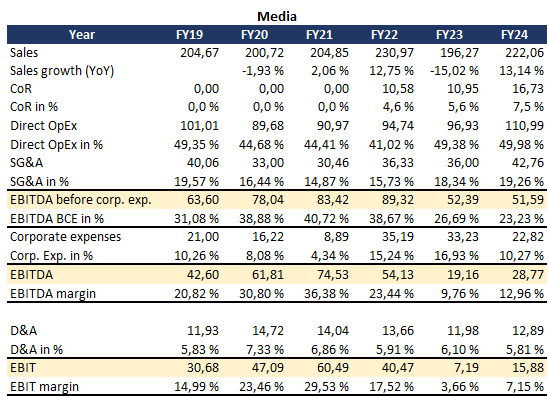

The Media segment has hit a rough patch from a profitability perspective, with EBITDA before corporate expenses decreasing north of 40% over the last two years. This was partly driven by lower sales in FY23 and Meta Platforms terminating its ASP partnership agreement last year, which accounted for 53% of consolidated revenue and 63% of the digital segment at the time. Rising salary expenses, increased investments into Media in anticipation of the 2024 election, and non-cash SBC also explain part of the noticeable decrease. As can be seen below, the rising sales figure has not yet translated to improved EBITDA.

While the P&L looks rather disappointing at first glance, it could be due to front-loaded investments (e.g., more newsroom hires). Whether the increased focus on Media was a good call or a dud remains to be seen, but further cuts in redundancies and streamlined operations should lead to meaningful reductions in corporate expenses.

This has already been illustrated by the $12.8m reduction in FY24 corporate expenses, which was partly due to a reclassification of certain corporate expenses (moving them to OpEx and SG&A), but also due to lower salary and bonus expenses and professional service expenses. Even with the meaningful y/y decrease, EVC’s common size corporate expenses of 10-15% are still substantially above the industry standard of 3-5%, suggesting that there is room for further reductions.

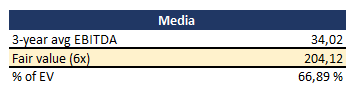

To get an idea of what segment EBITDA could look like after corporate expenses, I have, somewhat simplified, allocated corporate expenses proportionally based on segment sales. And since EBITDA is currently in a slump, I used the 3-year average EBITDA after corporate expenses as a proxy for normalized EBITDA - which totaled $34m. US mid-to-small market TV stations are typically valued at 6-8x EBITDA while radio stations are often sold in the range of 4-6x EBITDA. Since TV and radio are not reported separately, I have applied the midpoint of both ranges, equivalent to a 6x EBITDA multiple. If Media delivers $34m of annual EBITDA, this translates to $204m, or close to 70% of the current EV.

Ad-Tech

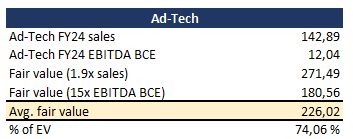

Ad-tech is a hidden gem buried inside a structurally declining broadcasting business. Segment sales grew 42% y/y, and delivered EBITDA before corporate expenses of $12m. AdTheorent, an adjacent peer, was acquired by Cadent, LLC, a platform-based converged TV advertising solutions company and portfolio company of PE firm Novacap, for $324m last June. The purchase price translated to acquisition multiples of around 1.9x sales and 15x EBITDA.

An important caveat is that while AdTheorent had delivered a 4-year sales CAGR of 9%, growth had started to slow, reaching only 2.9% and 0.4% in FY23 and FY22, respectively, a far cry from the 42% Ad-tech posted in FY24. Hence, one could argue that applying the same transaction multiples understates the fair value of Ad-tech. Still, the average of the two approaches yields a fair value of $226m, which covers 3/4 of EVC’s current EV - not bad!

Spectrum

Spectrum is the range of invisible radio frequencies that wireless devices use to communicate. It powers everything from TV and radio broadcasts to Wi-Fi, smartphones, satellites, and 5G networks. It is a scarce resource that you cannot just make more of, which is exactly what makes it so valuable. And it is the FCC that assigns specific frequencies from the broadcasting spectrum to individual stations.

The last FCC spectrum auction was held back in 2017. It generated $19.8b of total gross proceeds, led by T-Mobile and Dish Network with aggregate bids of $8b and $6.2b, respectively. EVC sold four spectrum licenses and received total proceeds of $264m, with the spectrum from its WUVN station getting more than $125m. With the FCC pushing for further deregulation, lawmakers are currently debating proposals to renew the FCC’s auction authority. This could make a new spectrum auction à la 2017 a reality (although likely at a meaningfully lower scale as the 5G craze has started to wear off).

EVC’s remaining spectrum licenses have a carrying value of approximately $177m. While this is only an accounting figure, I think it could serve as a low-end estimate as it has been consistently amortized since the last auction and monetization is now starting to seem more probable.

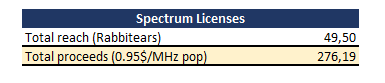

To estimate how much EVC could potentially fetch from a new auction, I will use the MHz-pop valuation approach.

EVC’s TV stations reach over 12 million US households, and RabbitEars reported that its total reach is around 49.5m individuals. In the 2017 incentive auction, the average spectrum valuation was around $0.93 per MHz-pop, and pairing this with the 6 MHz of spectrum TV stations are typically allocated, suggests that EVC could receive total auction proceeds of around $276 million.

And while TV stations are completely dependent on spectrum licenses to remain on air, EVC could enter channel sharing agreements (CSAs) to prevent remaining stations from going dark. I would actually go as far as to say that CSAs could be a net benefit to EVC as costs — including transmission, engineering and maintenance, and utilities— would be split with the other party based on bandwidth usage or negotiation terms.

One should also note that the above $ per MHz-pop was an average. The top 40 markets reached as much as $1.31 per MHz-pop in the 2017 auction, while certain rural areas only fetched $0.50 per MHz-pop. Interestingly, T-Mobile acquired 600 MHz spectrum licenses at $2.64 per MHz-pop from Columbia Capital in September 2022, and entered an agreement with Comcast a year later to lease and potentially purchase 600 MHz spectrum licenses for total considerations of $1.2b to $3.3b. The latter consideration implies around $2.21 per MHz-pop, highlighting larger players’ willingness to fork over a lot of cash for low-band spectrum.

Complete Sale

In addition to selling the three parts separately, a complete sale is also a real possibility. As

pointed out in his fantastic writeup, EVC moved its HQ from Santa Monica to Burbank in late 2024. Randomly (or maybe not?) enough, EVC is now headquartered in the same building as the Spanish-catering media company Estrella Media. MediaCo Holding (MDIA) acquired close to all its broadcasting assets for $200m in April last year, and exercised an option to acquire the remaining station licenses from its parent, Estrella Broadcasting, in an all-stock deal in February this year. These proceeds drove the total considerations to close to $210m.Soo Kim plays a pivotal role as he is MDIA’s largest shareholder through his hedge fund, Standard General, holding close to 91% of outstanding shares. He has built a reputation of identifying undervalued or distressed assets and turning them into profitable ventures through streamlining, reducing efficiencies and aggressive M&A to scale or pivot business models. His fund acquired a majority stake in Young Broadcasting for $75m post-bankruptcy, facilitated its merger with Media General back in 2013, and pocketed $300m of profit when it was sold to Nexstar Broadcasting group in 2016, around 5 years after the initial investment.

With this in mind and given EVC’s similar characteristics, a complete takeover does not seem like a stretch.

Searchlight Capital, a $17B private equity firm with a strong media track record, is also a potential suitor as mentioned by David. They have already shown interest in Spanish-language media with their 2022 acquisition of Hemisphere Media, and adding EVC to Hemisphere’s portfolio could create synergies and boost market share.

Notably, Searchlight also co-acquired a 64% stake in Univision in 2020, and Univision parent Televisa Univision holds a non-voting 10% stake in EVC—making Searchlight no stranger to the Entravision name.

There are clearly multiple ways to approach this, but by connecting the dots, we can map out a range of potential outcomes. If we add up the estimated fair value of Media, Ad-tech and potential proceeds from the sale of spectrum licenses, EVC’s fair EV could be close to $700m. Netting out NIBD (including marketable securities and operating lease liabilities) of $136m suggests that the FVPS is close to $6.5, implying more than a 3x from here.

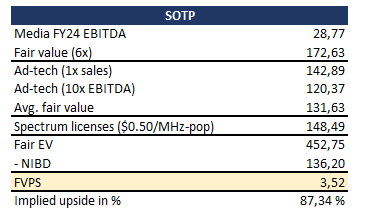

If the currently suppressed Media EBITDA turns out to be the new normal, Ad-tech is sold for 1x sales or 10x EBITDA, and EVC only fetches $0.50/MHz-pop for the spectrum licenses, the FVPS is closer to $3.5. Although this is more than 40% below what I view as the best case, it still represents nearly a double from the current share price.

Risk Factors

Even though the investment thesis seems quite compelling and there are several ways for EVC to double or even triple from here, there are certain ifs and buts making it less straightforward.

Limited Deregulation

While Chairman Carr has come out strong and clearly aims to spur a wave of deregulation in the US broadcasting industry, Congress could put a stop to it. If station ownership caps are not lifted, the anticipated surge in M&A activity will likely fall far short of expectations. And if the FCC is not granted auction authority, EVC may be unable to monetize its spectrum licenses.

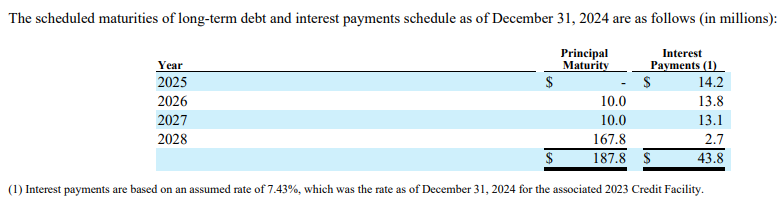

Debt Maturities

While most of outstanding debt matures in 2028, liquidity problems could arise if EVC’s current profitability slump persists.

From EVC’s 2024 10-K

The 3 year runway should be a sufficient window to deleverage, refinance or restructure, and the ~ $100m worth of cash on hand cuts the principal amount down to a much more reasonable $87m. Still, a prolonged recession and credit contraction could pose a real threat.

Recession

If a full-blown recession were to occur, advertising is among the first things companies cut. For a company that almost exclusively generates sales from ad spend (less than 10% comes from retransmission fees), this would materially impact results. Additionally, potential suitors might delay bids in anticipation of lowered valuations to scoop up media assets on the cheap.

Timing

Lastly, even complete crystallization of currently hidden value could lead to subpar returns if a complete sale, sale of Media or Ad-tech, or spectrum auction takes place many years down the road. I have not included the discounted proceeds from a sale or auction in the valuation as I do not know exactly when this would take place. Still, if we discount the proceeds at 10% and assume that they are received within the next 3 years, the implied upside from current levels is in the 40%-150% range. In other words, EVC should still deliver stellar returns from here provided the events unfold within a reasonable timeframe.

Catalysts

Station Caps Being Lifted

The current FCC National Broadcasting Ownership Cap restricts any single entity from owning stations that reach more than 39% of US TV households. While nuances like the UHF discount—allowing UHF stations to count only 50% of their audience reach—provide some flexibility, lifting the caps further could spur increased M&A activity.

Large players such as Soo Kim and Searchlight Capital have already expanded their station portfolios, and George Soros has recently made significant inroads into the broadcasting landscape. In 2022, a group associated with Soros funded the $60m purchase of 18 Hispanic radio stations from Univision, including Radio Mambí. And in early 2024, Soros Fund Management acquired more than $400m of Audacy's debt during its bankruptcy proceedings, making it the largest shareholder post-restructuring. The acquisition gave him considerable influence over more than 200 radio stations across 40 markets, reaching an estimated 165 million Americans, and lifted station caps might fuel continued station rollups.

Ad-Tech Growing

If Ad-tech continues its current growth trajectory, the segment will likely surpass Media soon and become EVC’s largest reporting segment. Its better growth prospect and expanding margins should also alter the market perception, warranting a multiple rerate.

FCC Spectrum Auction

The announcement of a new FCC spectrum auction will likely lead to an immediate increase in EVC’s value as the market begins pricing in the currently neglected spectrum licenses.

Final Words

At first glance, EVC might appear to be an underperforming and structurally challenged broadcaster, but a deeper look reveals a very different story. Christenson is a seasoned leader making the right moves to streamline operations and reposition the business, and his — along with Liberman’s and Boelke’s — decision to take meaningful salary cuts and opt out of the cash bonus plan entirely in exchange for RSUs and PUs suggests genuine alignment with shareholders.

The potential monetization of underappreciated spectrum licenses through a future FCC auction, paired with deregulation and the lifting of station caps, could trigger a wave of M&A activity across the broadcasting industry. A partial or full sale of EVC’s Ad-tech assets (Smadex, Adwake, or both) would also provide a clear path toward deleveraging. Meanwhile, the company’s outsized corporate expense base vis-à-vis industry peers indicate further room for cost-cutting and margin expansion.

While execution risks and a weakening macro backdrop remain, the combination of clear industry tailwinds, an incentivized management team, and a significant discount to fair value makes EVC a compelling asymmetric opportunity. And with a dividend yield approaching 11%, investors are paid to wait as the market catches up.

This is not investment advice. I hold shares of Entravision Communications (EVC) at the time of writing, and my views may be biased. Please do your own research and consult a financial advisor before making any investment decisions.

Great Write-Up.

I think with the veto power of Univision's U-shares over any M&A, and Searchlight's ownership of Univision. I think they would be the preferred buyer. I am unclear how the u-shares would impact the auction dynamics however. Could they force a lower sales price? I don't know.